ARTICLE AD BOX

In the last couple of hours, there has been havoc in the crypto market that caused nearly $500 million worth of trades to liquidate. What are the reasons?

The crypto market is always subject to massive volatility, often liquidating high-leverage trades in both directions. As millions were liquidated today, the actions of certain insiders have prompted the community to speculate whether they had prior knowledge of the impending events.

Game of Liquidations: Were Insiders Aware About Upcoming Crypto Market Crash?

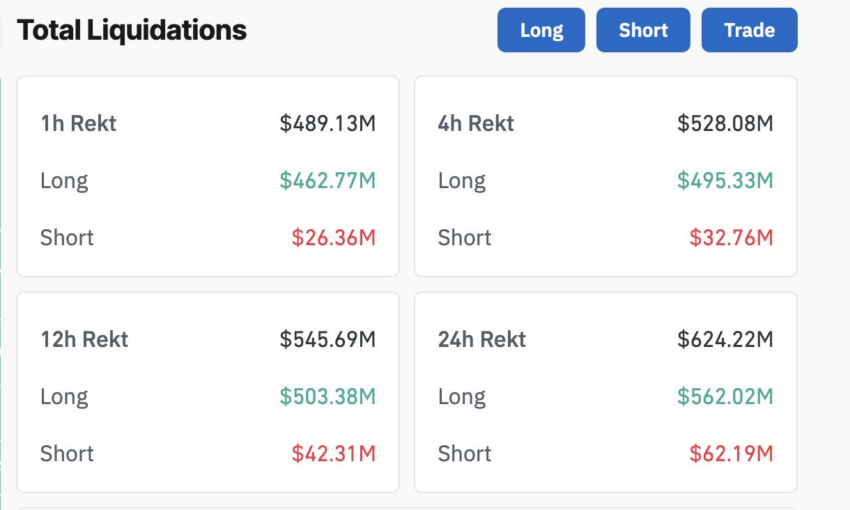

The screenshot below shows that nearly $500 million worth of crypto trades have crumbled to liquidation in the last hour. This includes $462 million in long positions and $26 million in short positions.

Meanwhile, the total liquidation amount for the last 24 hours is $624.22 million.

Total Crypto Liquidations. Source: Coinglass

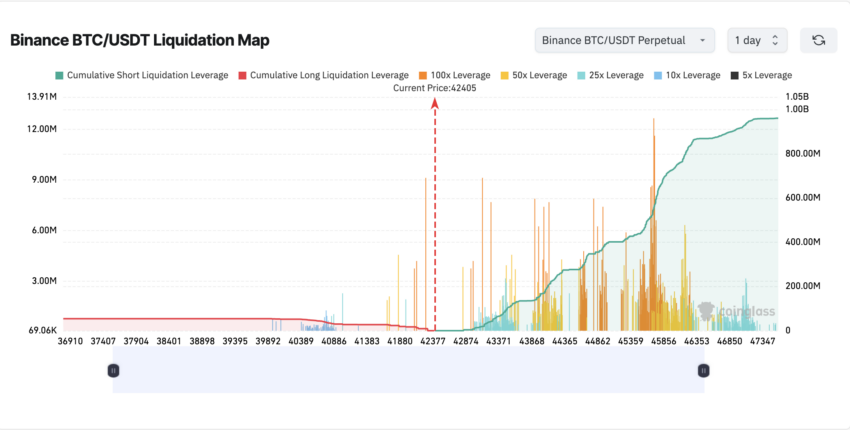

Total Crypto Liquidations. Source: CoinglassThe liquidations happened as the flagship crypto, Bitcoin (BTC), dropped 10% from the $45,000 range to $40,750. Similarly, Ethereum (ETH) dropped from $2300 to $2100. The screenshot below shows that long liquidations have been almost completely wiped off.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

Bitcoin Liquidation Map. Source: Coinglass

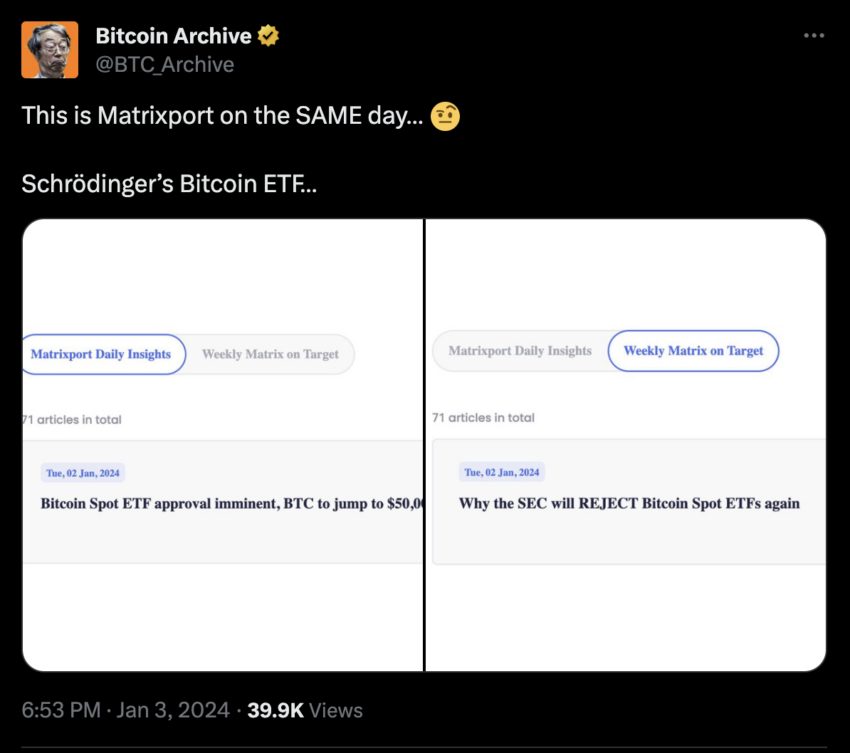

Bitcoin Liquidation Map. Source: CoinglassOne of the primary reasons for this dump is believed to be the report from the crypto financial services company Matrixport. The report discussed the possibilities of the US Securities and Exchange Commission (SEC) rejecting all spot Bitcoin exchange-traded fund (ETF) applications.

From the surface level, it may look like the report may be the sole reason for the crypto market dump. However, the community discovered that Matrixport also published another article on the same day – “Bitcoin Spot ETF approval imminent, BTC to jump to $50,000.”

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Matrixport Articles on Spot Bitcoin ETF. Source: X (Twitter)

Matrixport Articles on Spot Bitcoin ETF. Source: X (Twitter)Prior to Wednesday’s market crash, there have been reports about Coinbase insiders and MicroStrategy co-founder – Michael Saylor selling crypto stocks. In the wake of these insider sales, the price of Coinbase stock (COIN) has experienced a 16% drop since late December.

A community member wrote on X (Twitter):

“Insiders been selling #Crypto stocks. Makes you wonder what they know.”

Not to mention, BeInCrypto reported that institutions such as Alameda Research and Celsius Network have been depositing Ethereum to centralized exchanges. As a result, there has been a surplus deposit of 132,560 ETH in the past 7 days on centralized exchanges.

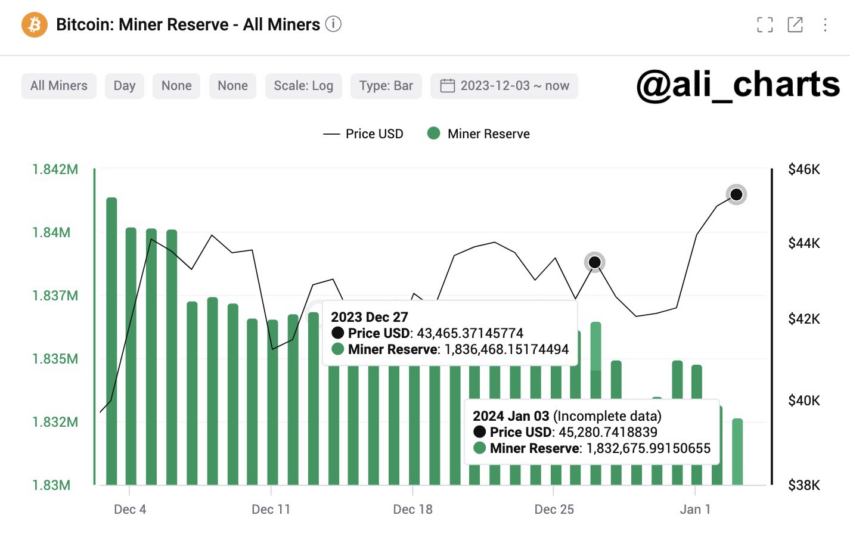

Additionally, Ali Martinez, the Global Head of News at BeInCrypto, posted on X (Twitter) that Bitcoin miners have been selling their BTC for the last 10 days. He wrote:

In just the last 10 days, #Bitcoin miners have sold approximately 4,000 $BTC, amounting to over $176 million!

Bitcoin Miners Sold 4,000 BTC in the Last 10 Days. Source: X (Twitter)

Bitcoin Miners Sold 4,000 BTC in the Last 10 Days. Source: X (Twitter)Do you have anything to say about the crypto market liquidations or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Top crypto platforms in the US | January 2024

The post Why $500 Million in Cryptos Were Liquidated Within 1 Hour appeared first on BeInCrypto.

.png)

10 months ago

3

10 months ago

3

English (US)

English (US)