ARTICLE AD BOX

As the cryptocurrency market continues to evolve, Ripple’s XRP has captured the attention of investors with a significant price surge. Here are three critical technical factors that may determine whether XRP’s bullish trend will persist.

1. Impressive Relief Rally

XRP has witnessed a remarkable 30% increase on the weekly chart, surprising many market watchers. The rally began when buyers robustly supported the price at $0.40, overcoming previous bearish sentiments. Currently, XRP is holding strong at $0.54, with the next resistance level identified at $0.68.

Source: TradingView

Source: TradingView2. Surge in Trading Volume

After enduring nearly two months of selling pressure, XRP buyers have made a strong comeback. The shift in momentum began on July 8, characterized by a significant increase in buying volume. This resurgence suggests renewed investor confidence, potentially setting the stage for further price appreciation.

Source: TradingView

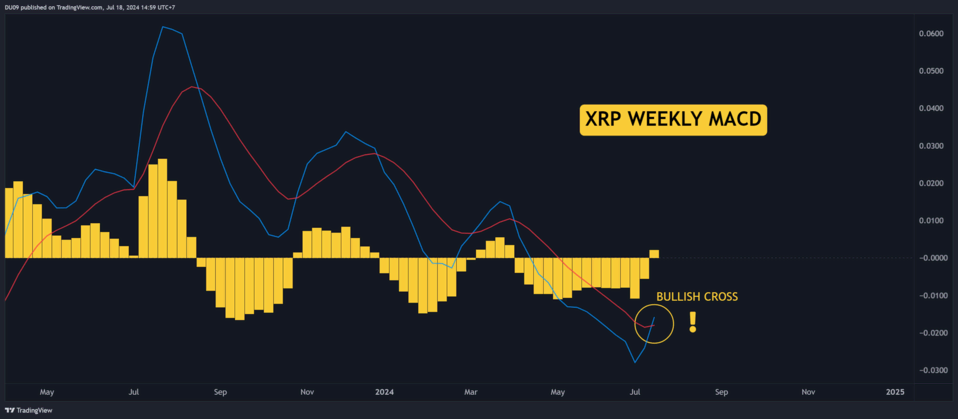

Source: TradingView3. Bullish MACD Cross

A critical bullish signal for XRP holders is the recent MACD (Moving Average Convergence Divergence) cross on the weekly timeframe. This technical indicator, often used to gauge the strength and direction of price trends, suggests that XRP could be on the verge of a sustained uptrend. To solidify this bullish outlook, it is essential for the weekly candle to close in green.

Source: TradingView

Source: TradingViewMarket Sentiment and Future Prospects

The recent price action and technical indicators provide a bullish outlook for XRP. However, investors should remain cautious and keep an eye on key support and resistance levels. The broader market conditions and regulatory developments could also impact XRP’s trajectory.

Disclaimer

The information presented in this article is for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct their own research before making any investment decisions.

Also Read: Altcoins Gain Momentum as Bitcoin Faces Resistance: SOL, AVAX, DOGE, XRP

.png)

3 months ago

3

3 months ago

3

English (US)

English (US)