ARTICLE AD BOX

Distributed ledger specialists Ripple Labs acquired digital asset custody firm Standard Custody and Trust. The purchase follows Ripple’s 2023 acquisition of Swiss custody firm Metaco to strengthen its tokenization presence amid rising interest in central bank digital currencies (CBDCs).

Ripple Labs bought Standard Custody and Trust to guarantee regulatory compliance as more institutions explore tokenization.

Ripple Adds Custody Expertise to CBDCs

The acquisition ensures that Ripple becomes regulated in more jurisdictions “to take advantage of current market conditions” following its acquisition of Swiss custody firm Metaco last year. Ripple provides regulated custody services to HSBC, BBVA, and Zodia Custody through Metaco. Ripple’s president, Monica Long, confirmed custody partnerships dovetail with the company’s long-term plans.

“By expanding our licenses portfolio and making smart acquisitions, Ripple is well-positioned to take advantage of the current market opportunities and further strengthen our crypto infrastructure solutions,” Long said.

Read more: Deploying Blockchain Infrastructure: Challenges and Solutions

Global regulators are developing increasingly tight crypto regulations for custodians. These include the segregation of client and corporate funds, the use of multiparty wallets, and industrial cybersecurity. Ripple CTO David Schwarz and its co-founder Arthur Britto pioneered the secure distributed ledger technology for PolySign, the parent company of Standard Custody & Trust, which could satisfy these requirements.

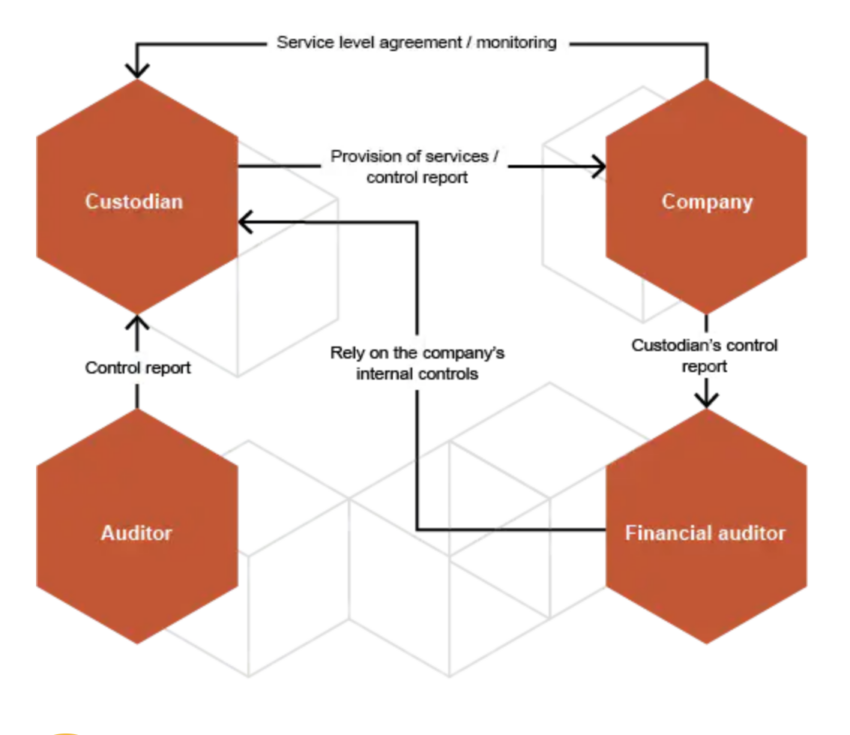

How Crypto Custody Works | Source: PwC Switzerland

How Crypto Custody Works | Source: PwC SwitzerlandRipple’s acquisition could also help its central bank digital currency infrastructure business. The company launched its CBDC platform in May last year. After that, the central banks of at least 11 countries expressed interest in using the blockchain infrastructure, with Montenegro and Georgia committing to pilots.

Can Ripple Help CBDCs Avoid Inflation?

But can Ripple’s CBDC technology improve the reliability of CBDCs? The absence of backing by physical assets has left more than one fiat currency vulnerable to devaluation and inflationary policies.

In Argentina, excessive money printing has led to a drastic decline of the peso’s value over the last decade. Zimbabwe still bears the scars of hyperinflation under the regime of former president Robert Mugabe. It is in these situations that Ripple’s technology could thrive.

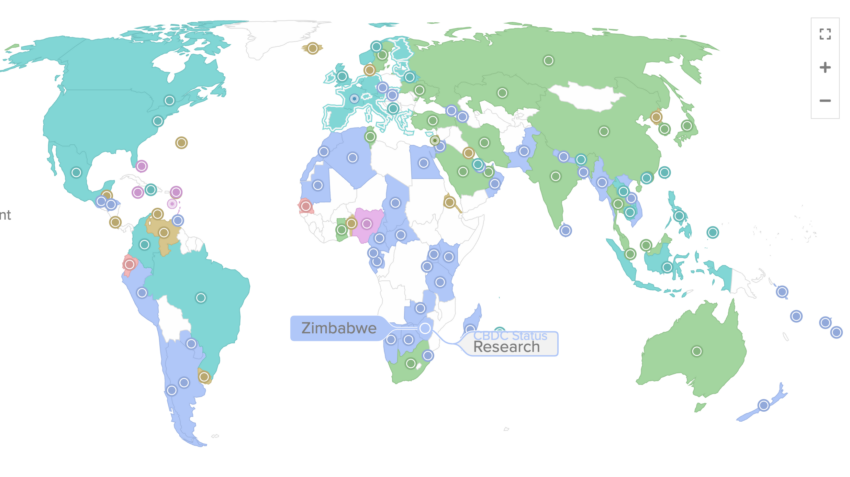

CBDC Development Stages | Source: Atlantic Council

CBDC Development Stages | Source: Atlantic CouncilRipple’s infrastructure could enable government-issued currency to transact on its ledger. This tender could be backed by tokenized versions of physical assets that can be the digital versions of the gold bars previously used by the US and touted by current central banks.

For example, Zimbabwe’s central bank recently announced a new measure to link its currency to a physical asset such as gold. The move would help the central bank control domestic liquidity, the country’s Finance minister, Mthuli Ncube, said this week.

“The idea going forward is to make sure that we manage the growth of liquidity, which has a high correlation to money supply growth and inflation. The way to do that is to link the exchange rate to some hard asset such as gold,” Ncube said.

Read more: Revolutionary Blockchain Ideas

Going one step further by tokenizing this gold and incorporating it into a CBDC would not be far-fetched. Last year, HSBC Holdings tapped Metaco to hold tokenized gold for its institutional clients. Ripple’s partnership with Standard Trust and its CBDC expertise could bridge the two systems to create a central bank digital currency fully backed by tokenized versions of hard assets.

BeInCrypto has contacted Ripple CEO Brad Garlinghouse regarding plans for African CBDCs but has not heard back at publication.

The post Will This Ripple Custody Company Aid CBDC Efforts in Struggling Economies? appeared first on BeInCrypto.

.png)

9 months ago

3

9 months ago

3

English (US)

English (US)