ARTICLE AD BOX

Worldcoin’s (WLD) price could be recovering on the back of investors’ accumulation, which is likely given the potential for losses.

The on-chain indicators support a bullish outcome, provided investors stay on track with growth.

Worldcoin Investors Push for a Rally

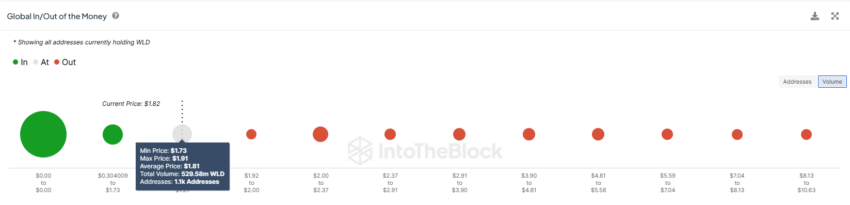

The recent decline in Worldcoin’s price resulted in the altcoin losing the support of $2. According to the Global In/Out of the Money (GIOM) indicator, about 530 million WLD worth over $960 million are close to losing their profitability.

Investors bought this supply between $1.71 and $1.93. Given that WLD is changing hands around $1.83 and testing the support of $1.76, the altcoin may lose its profits.

Worldcoin GIOM. Source: IntoTheBlock

Worldcoin GIOM. Source: IntoTheBlockHowever, for Worldcoin’s price to rebound, investors would need to act in accordance. The demand for the asset needs to increase, which is possible since the altcoin is currently undervalued.

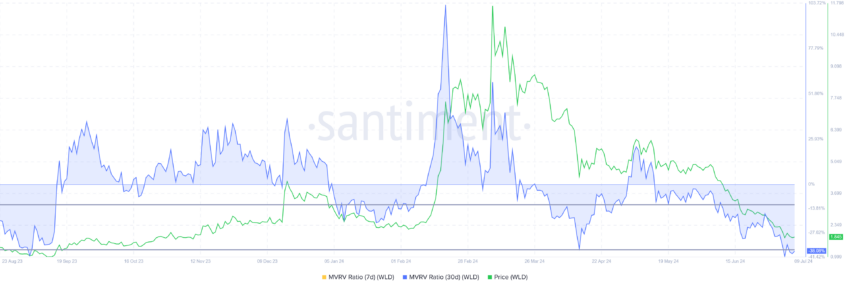

According to the Market Value to Realized Value (MVRV) ratio, there is an opportunity for accumulation. The MVRV ratio assesses investor profit and loss. Currently, Worldcoin’s 30-day MVRV stands at -37%, indicating profitability, which may lead to buying pressure.

Historically, WLD MVRV between -11% and -37% usually signals the start of recoveries and rallies, marking an opportunity zone for accumulation. This could help push the price back up.

Worldcoin MVRV Ratio. Source: Santiment

Worldcoin MVRV Ratio. Source: SantimentWLD Price Prediction: Recovering Gains Is the Target

Worldcoin’s price is currently at $1.83, under the critical price of $2.0. Following the 63% drawdown in the past month, the altcoin has attempted to breach it and flip it into support again.

This is likely, looking at the aforementioned factors. Should this happen, WLD is open to a rise towards $3.0, which would warrant consistent bullishness from the investors.

Worldcoin Price Analysis. Source: TradingView

Worldcoin Price Analysis. Source: TradingViewOn the other hand, a failed breach would result in the crypto asset potentially losing support of $1.76 and falling to the lows of $1.50, invalidating the bullish thesis.

The post Worldcoin’s (WLD) Price Fall Puts $960 Million Profits in Jeopardy appeared first on BeInCrypto.

.png)

4 months ago

1

4 months ago

1

English (US)

English (US)