ARTICLE AD BOX

- An XRP community expert predicts the cryptocurrency could reach $20,000 per token, citing deflationary supply and institutional adoption as key factors.

- He suggests banks may adopt XRP as a reserve asset and use private ledgers to facilitate secure transactions.

A prominent XRP community figure has predicted a massive price increase for the cryptocurrency, with the token reaching $20,000. Chad Steingraber, a game developer and an XRP proponent, shared some reasons for this aggressive forecast, including deflationary supply, institutional uptake, and possible supply disruptions as drivers.

Steingraber pointed out that there is a limited amount of XRP, which is a deflationary factor. The XRP Ledger also eliminates tiny quantities of XRP in every transaction and puts the remaining XRP out of circulation. Out of the total 100 billion tokens, 57 billion tokens are in circulation.

He pointed out that some tokens are gone forever, which also affects the availability of tokens. This scarcity, coupled with increasing demand, may lead to the environment for potential and fairly substantial price increases.

Institutional Adoption and Private Ledgers

In a similar vein, Steingraber argued that XRP could be used as a bank reserve currency, similar to gold. He said that financial institutions might come up with their own digital currencies, such as BOAcoin or JPMorganCoin, based on private XRP Ledgers. These bank-specific coins could use XRP as a reserve asset to enable private transactions without going through public ledgers.

He also spoke about the institutional liquidity providers (ILPs) in this ecosystem. ILPs would act as a bridge, holding significant XRP and ensuring efficient cross-border transactions with no risk of default. For example, a transaction between Bank of America and JPMorgan could implement XRP as the median currency, utilizing ILP to facilitate the exchange without complications.

Potential Supply Shock

Steingraber pointed out that a supply shock may occur if institutional demand rises. He opined that financial institutions and ILPs could fasten the purchasing of XRP and thus exhaust the public market in a few years. This intense buying could cause a price spike that would exclude retail investors.

He stated that the world economy is $40 trillion, which includes the U.S. dollar supply alone, and the ever-expanding derivatives market will create a high demand for XRP. If the circulating supply were reduced to Bitcoin’s 21 million max supply, the token price would skyrocket.

However, Steingraber admitted that there could be some constraints to the projection. For the adoption of XRP as a reserve currency to go viral, the world requires a clear legal framework and institutional understanding of the technology. To get XRP from the current price of $2.54 up to $20,000, the coin must grow 78,740.16%. This is only possible if the market makes seriously unrealistic assumptions about future adoption rates and demand.

XRP Rises Amid Market Decline

XRP is trading at $2.54, marking a 4.08% increase over the past 24 hours and a 5% increase in the past 7 days. The token has been rather unstable, with the highest price of $2.55 in the last 24 hours and the minimum of $2.34.

[mcrypto id=”345586″]

CoinShares reported that XRP investment products saw more than $41 million in inflows last week. These inflows distinguished XRP from other major coins, which recorded weak performance.

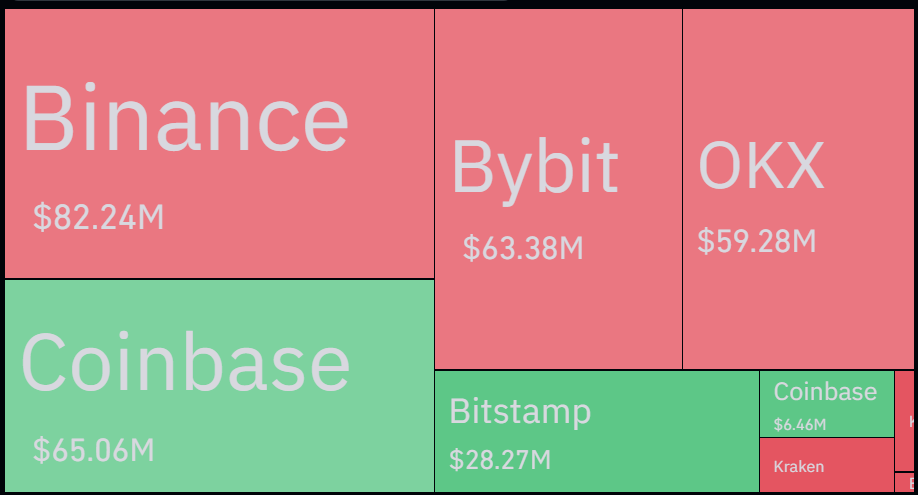

The asset is the only token in the top 20 by market capitalization that is in green on a weekly time frame. Net outflows from major exchanges are also driving bullish momentum in XRP. In the past week, Binance lost $82 million, Bybit lost $63 million, OKX lost $59 million, and other exchange platforms lost a total of $168 million. On the other hand, institutional investors in the US via Coinbase were more conservative and pumped in $65m in inflows.

Source:Coinglass

Source:Coinglass.png)

7 hours ago

4

7 hours ago

4

English (US)

English (US)